20220726

<Gold Market Review>The Head of Gold Falling Formed, will the History be Repeated?

A sharp surge in the euro is behind the latest fall in the US. The ECB said it expects to tighten monetary policy further this year to cope with the rising inflation. The rate of the EUR jumped after the news of the ECB rate hike by 50 basis points. The euro rose more than 1% against the US dollar during the day, and the US index once fell to 106.42. As the dollar pulled back, there were some fresh buying incentives in the gold market, taking the opportunity to move higher at the $1,680 level.

Even so, the gold has traded sideways for most of the past two months and there is no such upward trend at all. This proves that the major central banks, especially the Fed's current move to speed up interest rate hikes, have become a key factor suppressing the performance of gold. Even if there is a recession and fear of rising interest rates, it will not be enough to give any incentives for the rising in the gold price. Meanwhile, SPDR Gold Trust, the world's largest gold-trading fund, stated that the gold-backed ETF holdings fell 0.5% to their lowest level since late January. In the long run, the gold price will only have a better reason to rise if the Fed hints at signs of easing its tightening plans.

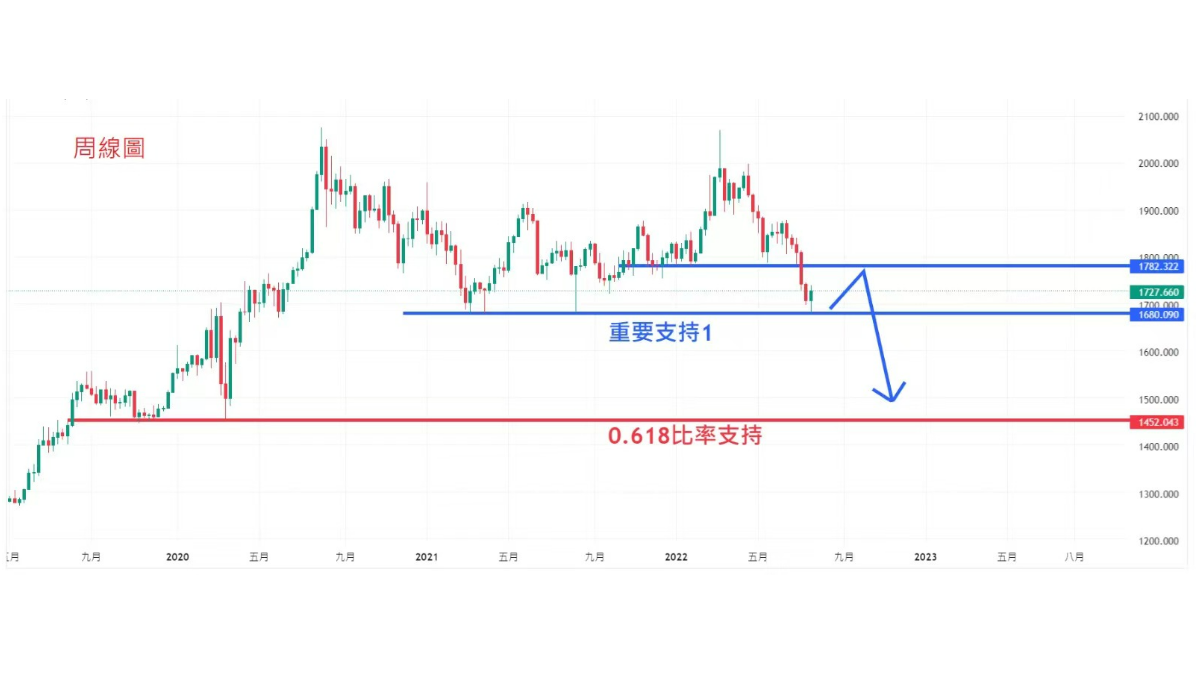

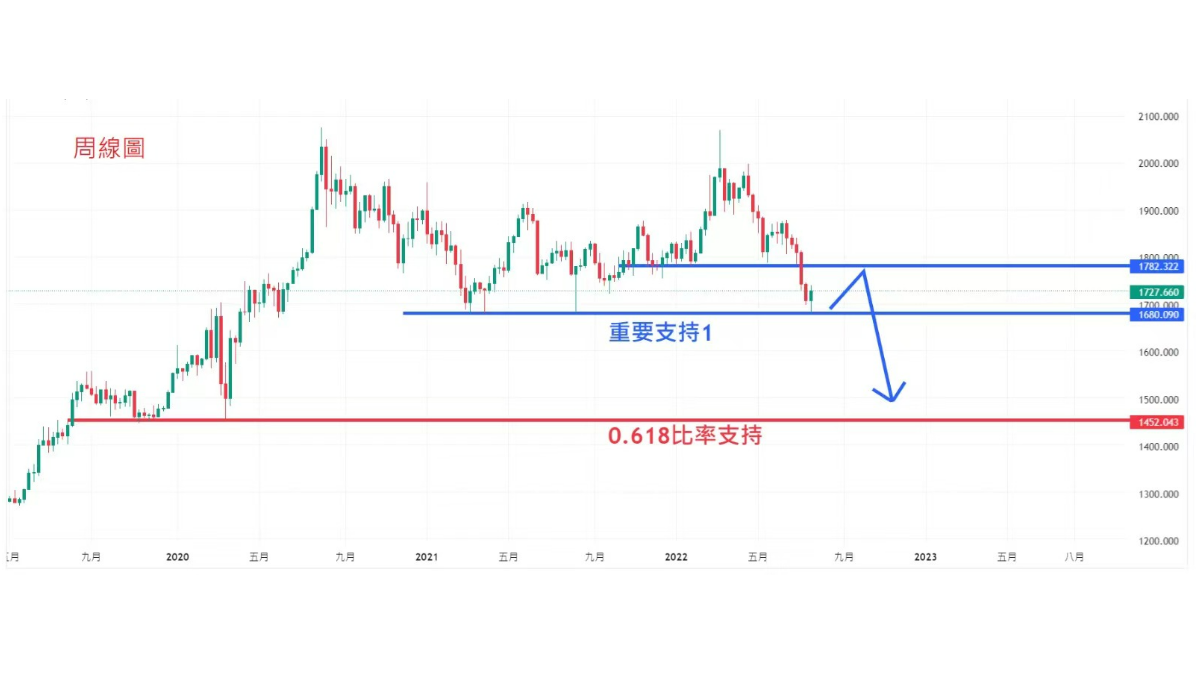

Technically, on the weekly chart, it has not yet effectively fallen below the support near the low of 1,680 in August last year. We still need to focus on this position. Once it breaks down, there will be a blank area below and there is no support at all. At that time, the decline is expected to be rapid, and it is possible to further test the support of the lows around 1,460 - 1,500 in March 2020. But for the time being, the 1,670 - 1,677 area support is relatively strong and rebounded on July 22. Thus, the possibility of further breaking the support near 1,670 is relatively low. In addition, it is also necessary to beware of a possible volatile rebound in the price of gold before effectively falling below the 1,680 mark. The upper resistance is near $1,800. If it recovers successfully, it will weaken the short-term bearish signal.

In conclusion, the general pattern of gold is in a downtrend. The so-called follow the trend will only focus on short opportunities, but not recommended to go short at the support area of 1,680. On the contrary, it is relatively beneficial to intervene in the short position at the right time. Investors can pay attention to the short-selling opportunity to take advantage of the trend to short-sell to gain a profit space of more than 200 US dollars below when there is a weakening signal around 1,780 - 1,800. This will remind me of the moment when gold crashed in 2013. On the 20MA, the pattern at that time was similar to the current trend. After the head formed, it was directly inserted into the 0.618 positions of the ratio. The 1,460 - 1,500 support area mentioned above is also the ratio position of 0.618. If this is the same case, the gold price is expected to repeat the decline of that year.

Hugo Leong Gold Analyst of Hantec Group

Weekly Chart

Extended Reading

<Gold Market Review>Suggest to Increase Holdings of Gold Moderately and Focus on Buying on Dips

BY Group Branding and Promotion FROM Hantec Group

《錦繡河山》鄧予立美國巡迴攝影展

BY Holly Wong FROM Hantec Group

<Markets Analysis>The Market Intends to Weaken the US Dollar

BY Group Branding and Promotion FROM Hantec Group

Units 4609-4614, 46/F, COSCO Tower, 183 Queen's Road Central, HK

(852) 2214 4101