20220125

<Gold Market Review>The End of the Gold Consolidation, Looking Forward to Breaking Through the Boring Situation!

Because of the current high inflation data in the United States, the Fed's tightening policy is imperative. The market generally believes that the Fed will consider raising the interest rates in March. However, the recent trend of the US dollar has shown some signs of peaking. The Fed's rate hike has been expected. Can the dollar continue to rise, after the announcement of the rate hike? In addition, will the ongoing geopolitical factors between Russia and Ukraine force funds to seek shelter in the safe-haven market? It will be the important factor affecting the rise in gold prices this year.

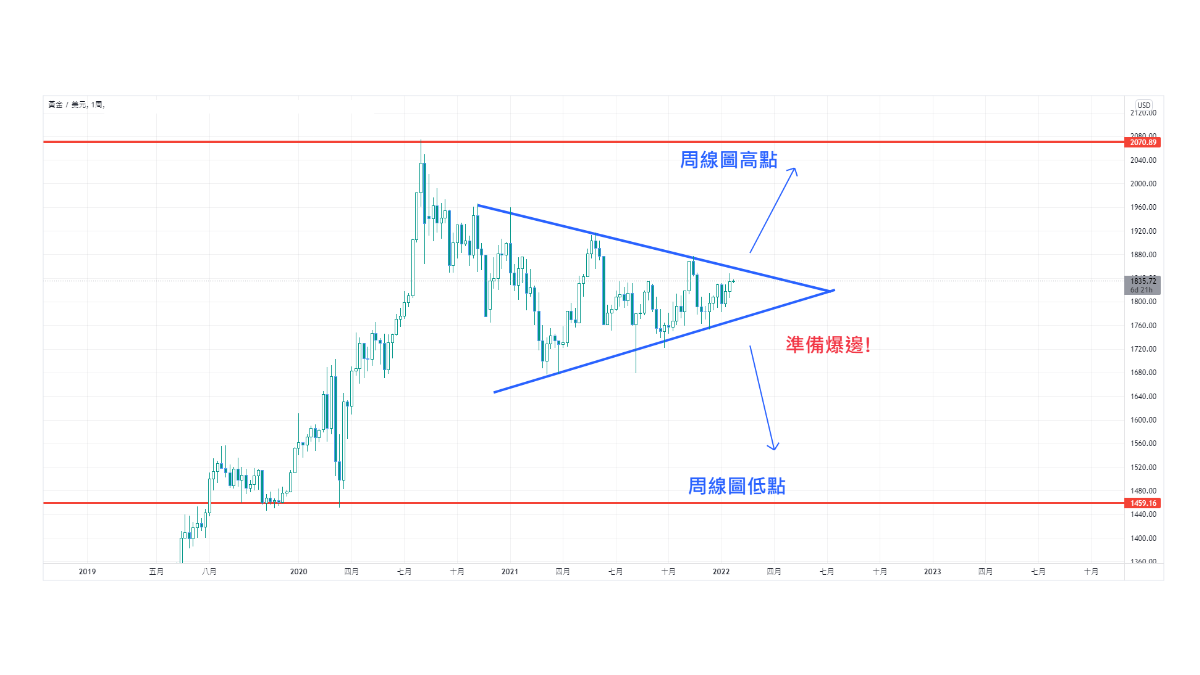

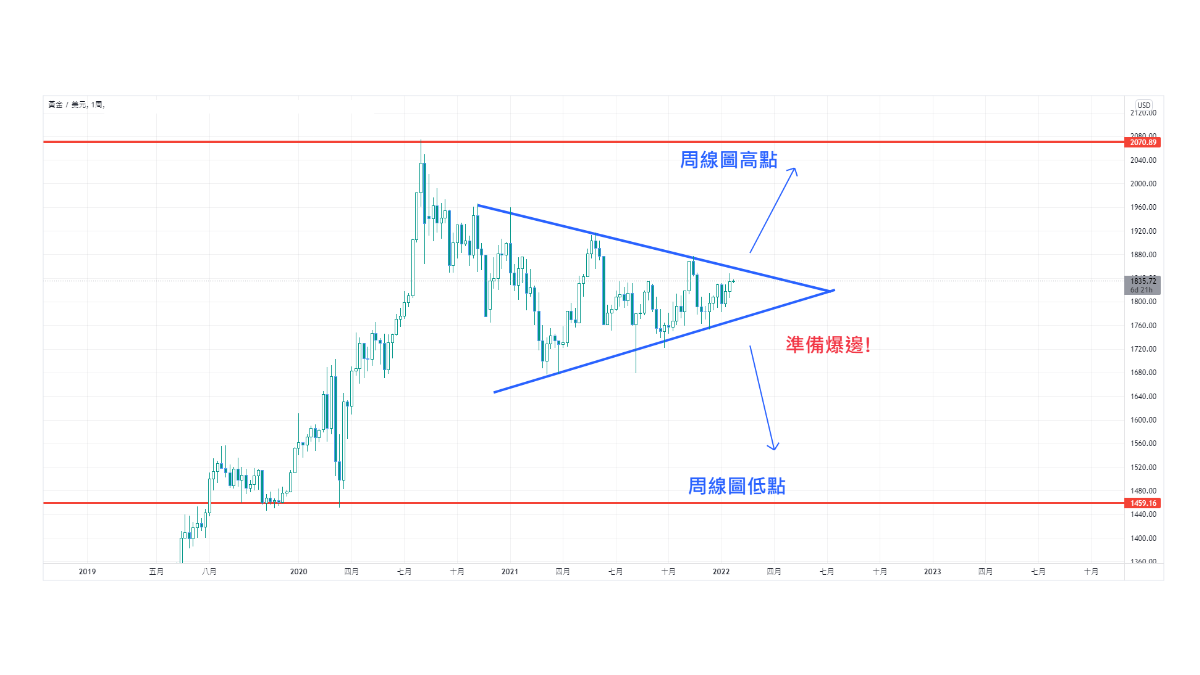

In the past year, the price of gold has mainly fluctuated in the range of US$1,675 to US$1,960. In recent months, the volatility has tended to narrow. It is shown on the weekly chart in Figure 1. In terms of technology, the consolidation of the big cycle is coming to an end. And the price of gold is expected to break through the triangle pattern in short term. Expecting the upper and lower targets after the triangle explosion will be $2,000 upstairs and $1,500 downstairs, respectively.

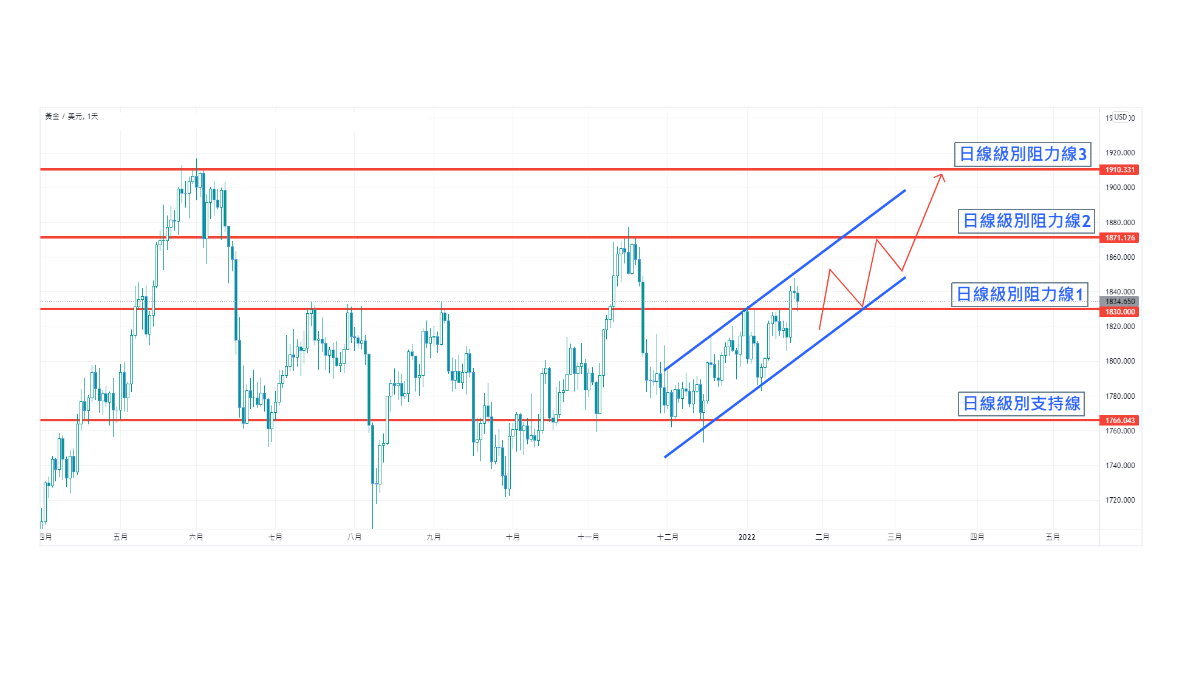

From the daily chart of Figure 2, gold stabilized at US$1,766 and moved upward. On January 19th, it broke through the key resistance level of US$1,830 which was mentioned earlier. On January 20th, it hit 1,848, the high in the past two months. The US dollar, which is now in the correction stage, needs to verify the stability of 1,830 again. Based on the resistance of $1,830 becoming as support, there are two technical views, one is to keep rising, and the upper target can be seen as resistance at $1,870 to $1,910, but I think that if you want to maintain a rising view, you cannot fall below the support line 1,830.

For the second opinion: refer to the daily chart of Figure 3, the highs and lows of gold have been raised during the rising process. This is an ideal rising pattern. If the pullback is too strong, it will fall below the recent low (G), which weaken the upward momentum, and the possibility of turning downward will become stronger. At that time, a false breakthrough will be formed at $1,830 again. The view will be more conservative, at least in the short term, we will no longer blindly pay attention to the bulls, or will return to the previous range of oscillations. Once this happens, the downside shock target can reach $1,766.

Hugo Leong Gold Analyst of Hantec Group

Figure 1

Extended Reading

<Gold Market Review>Tensions in the Middle East, Boost Gold Up to 2,000 Level

BY Group Branding and Promotion FROM Hantec Group

<審時度勢> 技術走勢出現突破 小心美匯下行趨勢

BY Group Branding and Promotion FROM Hantec Markets (Australia) PTY Limited, HMA

Hantec Group Participated in Food Sharing Project Volunteer Activity

BY Group Branding and Promotion FROM Hantec Group

Units 4609-4614, 46/F, COSCO Tower, 183 Queen's Road Central, HK

(852) 2214 4101